lhdn e filing guide

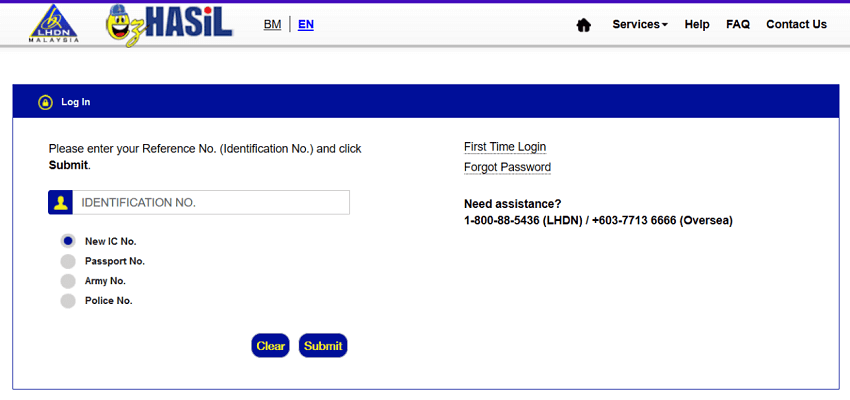

- Ensure company complies with federal state and local legal labor requirements by studying existing and new legislation. 1 Akses ke laman web e-Filing ezHASiL.

How To File Income Tax In Malaysia Using E Filing Mr Stingy

- Manage the survey prepare and update relevant report or data to.

. Enforcing adherence to requirements. Guide To Using LHDN e-Filing To File Your Income Tax. For those who are unaware Lembaga Hasil Dalam Negeri LHDN allows you to claim tax relief for medical expenses for yourself spouse and child with a sub-limit specifically for medical check-ups.

How To File Income Tax As A Foreigner In Malaysia. Niagawan Plus Sdn Bhd 110-2-21 Summerton Avenue Persiaran Bayan Indah 11900 Bayan Lepas Penang Malaysia. Advising management on.

Sales and Service Tax RM25 on each principal and supplementary card upon activation and anniversary date Minimum Monthly Payment RM50 or 5 of outstanding amount whichever is higher Late Payment Fee. Guna Google search untuk kata kunci ehasil ezHASiL atau LHDN. E-Filing Organization Download CP55B CP55C.

Every time you fill in the LHDN e-Filing form you are automatically eligible for an income tax relief of RM9000. E 2020 Explanatory Guide Notes. Guide To Using LHDN e-Filing To File Your Income Tax.

E-Filing Prefill Data Login Prefill e-Data e-Filling RPGT e-Form Login WHT e-Form Login e-Lodgement CKHT e-Form Login. Bukan sistem yang biasa-biasa. How To File Income Tax As A Foreigner In Malaysia.

A s s i s t a n c e e-Filing Handbook e-Filing User Guide m-Filing User Guide e-Filing FAQ. Learn more about Standard Chartered FlexiPay Plus Fees Charges Annual Fee. How much is taxable income in Malaysia for Year Assessment 2021.

Oleh itu lebih baik gunakan fungsi carian google. M-Filing User Guide e-Filing FAQ Prefill Data FAQ. - Ensure the execution of ground planning works and on-site testing are conducted properly.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. E - Filing Tax Agent First Time Login Login Download CP55 CP55A. Filing your tax through e-Filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on April 30.

How To File Your Taxes Manually In Malaysia. First year free for new customers only. APPLICATION FORM FOR ORGANIZATIONAL e-FILING PIN NUMBER.

Anda boleh rujuk pada ringkasan yang disediakan untuk isi maklumat yang diperlukan di dalam borang e-Filing LHDN. Bergantung kepada pengurus website LHDN url diatas mungkin akan berubah dari masa ke semasa. CP55B In PDF Format This form can be downloaded and used.

Select Accounts Banking then select Bill Payment. Keep all your receipts. Guide To Using LHDN e-Filing To File Your Income Tax.

Jadi team kami akan guide anda secara langkah demi langkah untuk setup akaun anda dengan betul. If you are unclear about CP8D form you may refer to the updated guide created by LHDN below. How To File Your Taxes Manually In Malaysia.

How To Pay Your Income Tax In Malaysia. E - P a y m e n t e-Payment via FPX. Anda boleh akses e-Filing LHDN dengan.

- Guide management and employee actions by researching developing and updating HR policies and guidelines by enforcing company values. Dengan Niagawan boleh nampak untung rugi keluar masuk inventori dan macam-macam. Apa jadi selepas.

How To Pay Your Income Tax In Malaysia. If youre a very busy person or if this is your first time doing this you might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively. CANCELLATION OF COMPANY DIRECTORS AUTHORITY FROM USING ORGANIZATIONAL e-FILING.

Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. - Manage and guide the construction site inspection and make sure they are in accordance to engineering plan and specification. In Budget 2021 the tax relief limit was raised from RM6000 to RM8000 and the sub-limit was doubled from RM500 to RM1000.

How To Pay Your Income Tax In Malaysia. How to make a LHDN payment. However you will be required to use the Form MMT Borang MMT instead of the Form BBE.

2022 Malaysia Income Tax e-Filing Guide For Newbies CompareHero. Take note of the LHDN e-filling 2021 deadline. E - Filing Tax Agent First Time Login Login Download CP55 CP55A.

Non-residents filing for income tax can do so using the same method as residents. According to LHDN Income Tax Rates page the chargeable income tax in Malaysia for Year Assessment 2021 follows the following table. Tax Offences And Penalties In Malaysia.

If this is your first time filing your tax through e-Filing dont worry. People with disabilities who are registered with written confirmation with the Department of Social Welfare JKM get an additional exemption of RM6000. Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by sending an e-mail to CP8Dhasilgovmy.

Tax Offences And Penalties In Malaysia. Personal Income Tax e-Filing for First Timers in Malaysia MyPF.

How To Apply Pin No During Mco Yau Co

How To File Your Personal Income Tax A Step By Step Guide

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Understanding Lhdn Form Ea Form E And Form Cp8d

E Government Policy Ground Issues In E Filing System

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

It S Tax Season Here S A Comprehensive Guide On Claiming Income Tax How To Get Your Money Back

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To File Income Tax In Malaysia Using E Filing Mr Stingy

Mytax One Stop Portal To Make Tax Filing More Convenient

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Federal Income Tax Refunds May Be Delayed By Stimulus Mistakes Paper

Ctos Lhdn E Filing Guide For Clueless Employees

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

How To File For Income Tax Online Auto Calculate For You

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Comments

Post a Comment